- Contact:Minister Xu

- Mobile:13841408476

- Tel:024-44837288

- Fax:024-44837004

- E-mail:xuming58@126.com

- Web:natashaterry.com

- Address:No.110 XiangHuai Road

Benxi Economic Development Zone

Liaoning Province

Does RBC Bearings Incorporated's CEO Salary Compare Well With Others?

04 Jun,2019

In 1992 Michael Hartnett was appointed CEO of RBC Bearings Incorporated (NASDAQ:ROLL). This analysis aims first to contrast CEO compensation with other companies that have similar market capitalization. Then we'll look at a snap shot of the business growth. And finally - as a second measure of performance - we will look at the returns shareholders have received over the last few years. This process should give us an idea about how appropriately the CEO is paid.

How Does Michael Hartnett's Compensation Compare With Similar Sized Companies?

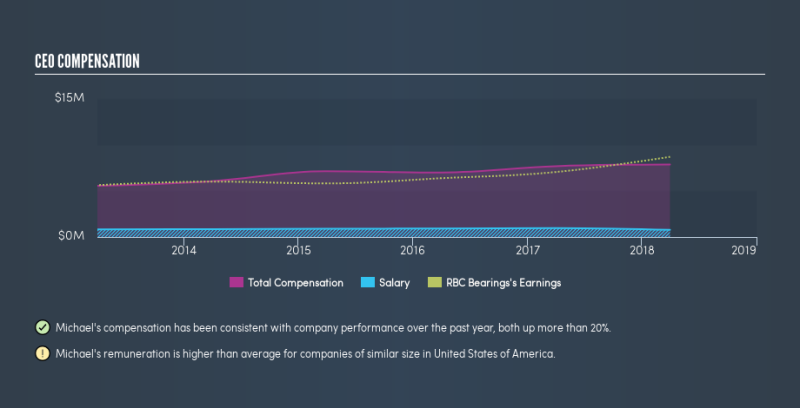

According to our data, RBC Bearings Incorporated has a market capitalization of US$3.5b, and pays its CEO total annual compensation worth US$7.9m. (This figure is for the year to March 2018). While we always look at total compensation first, we note that the salary component is less, at US$775k. When we examined a selection of companies with market caps ranging from US$2.0b to US$6.4b, we found the median CEO total compensation was US$5.3m.

It would therefore appear that RBC Bearings Incorporated pays Michael Hartnett more than the median CEO remuneration at companies of a similar size, in the same market. However, this fact alone doesn't mean the remuneration is too high. A closer look at the performance of the underlying business will give us a better idea about whether the pay is particularly generous.

The graphic below shows how CEO compensation at RBC Bearings has changed from year to year.

NasdaqGS:ROLL CEO Compensation, June 3rd 2019

Is RBC Bearings Incorporated Growing?

RBC Bearings Incorporated has increased its earnings per share (EPS) by an average of 16% a year, over the last three years (using a line of best fit). It achieved revenue growth of 4.1% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's nice to see a little revenue growth, as this is consistent with healthy business conditions.

Has RBC Bearings Incorporated Been A Good Investment?

Boasting a total shareholder return of 89% over three years, RBC Bearings Incorporated has done well by shareholders. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

We compared total CEO remuneration at RBC Bearings Incorporated with the amount paid at companies with a similar market capitalization. Our data suggests that it pays above the median CEO pay within that group.

However, the earnings per share growth over three years is certainly impressive. In addition, shareholders have done well over the same time period. So, considering this good performance, the CEO compensation may be quite appropriate. Arguably, business quality is much more important than CEO compensation levels.